ESG (Environmental, Social and Governance) is business management based on the principles of a meaningful and responsible attitude towards the environment, society and management tasks. ESG occupies an important place in the structure of modern business, increasing its environmental, social, managerial and economic efficiency.

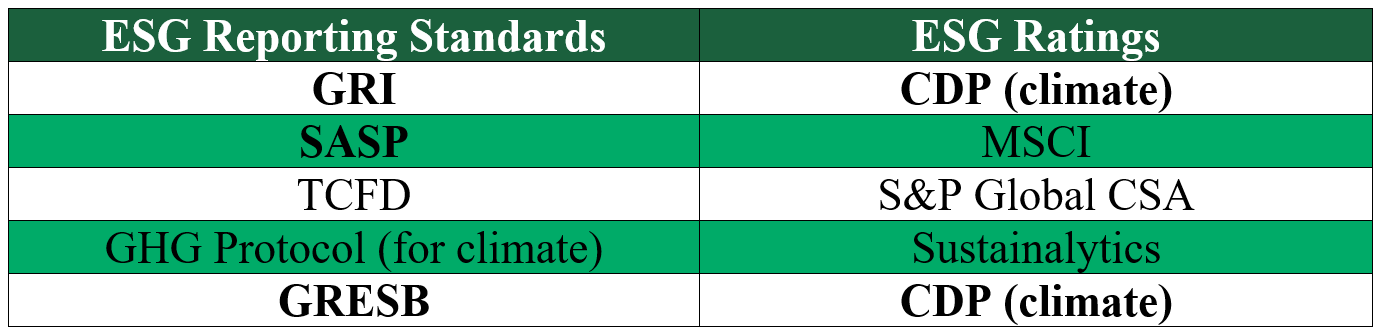

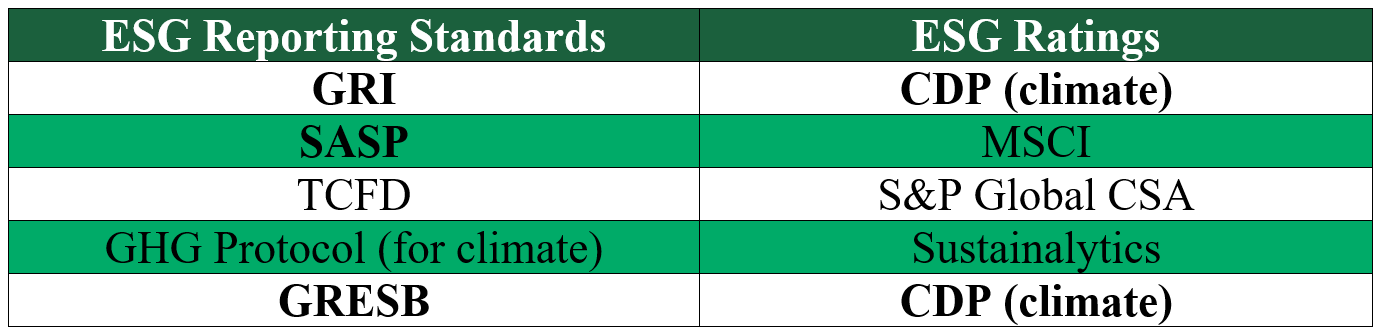

ESG reporting and ESG standards

Non-financial reporting standards

Our role is to develop an ESG strategy for business transformation:

- Diagnostics of the current level of development in the company of ESG principles, factors and risks according to all ESG criteria.

- Determination of the most priority areas for the implementation of ESG principles in the company’s business processes.

- Development of a roadmap for the implementation of ESG principles in business at the stages: short-term, medium-term and sustainable business in the long term.

- Consultations on the implementation of the ESG policy in the company’s business processes.

- Increasing the company’s ESG performance.

The implementation of these tasks allows:

- Assess the current state of risk management associated with ESG factors, determine the company’s development strategy in accordance with the principles of ESG, determine the level of company sustainability.

- Form steps to disclose information about the company’s ESG indicators, form a strategy for working with non-financial reporting.

- Strengthen the company’s business reputation, attract investors and clients interested in cooperation with risk-tolerant ESG-oriented companies.

- Reduce economic risks for business by stabilizing the ESG principles of responsible business, taking into account global trends and global policies (carbon regulation, social development goals, etc.).

Reasons for considering ESG factors in business:

- Financial markets

- Exchange requirements

- Company capitalization – ESG

- Investor Requirements

- Corporate requirements of the company and partners

- Separation from competitors

- Improving business efficiency

- International Status

- Taxes and duties

- Requirements of buyers and clients

- Entering the export market

- Risk reduction

- Innovation

Many investors and clients prefer ESG-oriented companies that meet the requirements of sustainable development and take into account the risks of development in the long term.

Understanding and applying ESG principles allows you to quickly adapt to changing market requirements, set strategic development goals and develop new products. The emphasis is on leveling risks and creating long-term increased value for the company.

https://hpbs.io/en/news/esg-non-financial-reporting-standards/

https://hpbs.io/en/news/where-to-study-esg-and-green-economy/

https://hpbs.io/en/news/mechanism-for-increasing-the-esg-rating-in-construction/

https://hpbs.io/en/news/ghg-calculation-case-for-international-reporting/